Pricing is a strategic decision that can greatly affect your business.

But it’s hard. And it’s one of the topics that doesn’t get enough attention.

In Today’s newsletter:

Monetization vs. pricing vs. packaging strategy

Why do we need the right pricing strategy?

The Value Stick

10 product pricing strategies every PM should know

🔒 Pricing strategy in the context of product strategy

🔒 9 product pricing tactics

🔒 Van Westendorp survey (OpenAI’s approach)

🔒 Conjoint Analysis

🔒 Conclusions

1. Monetization vs. pricing vs. packaging strategy

Before we dive in, let's establish some common definitions.

There are three related concepts:

Monetization strategy*: Monetization is a broad concept that encompasses not only how we generate revenue but also when. It might include multiple revenue streams, partnerships, or affiliate networks. Monetization incorporates both pricing and packaging strategies.

Pricing strategy: Pricing involves setting a cost for a product based on various factors. These can include the perceived value of your product, market conditions, and competitors' prices.

Packaging strategy: Packaging includes how a product is bundled and presented to customers. In particular, it involves leveraging psychological aspects such as:

Building a sense of urgency, for instance, by offering a time-limited deal.

Increasing the perceived value of a product, for example, by positioning a product you wish to sell alongside one that's significantly more expensive.

*I've used the suffix "strategy" because this is how we commonly refer to those terms. Please keep in mind that the term “strategy” is commonly overused. For more information, see Introducing the Product Strategy Canvas.

2. Why do we need the right pricing strategy?

Some might be puzzled I’m asking that question. Isn’t it obvious?

Not necessarily.

Here are 5 different goals you might want to achieve:

2.1 Maximize revenue

One of the most common reasons for setting the right price for your product is maximizing revenue. However, this is not always a valid reason.

I remember a small sales-led company that contacted me a few months ago. They tried to maximize revenue, whatever it took. But even though they were growing fast, they were losing money every month.

We analyzed their data. It turned you they grew in many market segments, including those that were not profitable (CAC, LTV). As a result, they were compromising their ROI.

We identified the most profitable “customer clusters.” Those became the primary focus of their marketing and sales efforts.

-

Depending on your situation, stage of a business, and goals, you might want to maximize one of those two metrics:

Net income = Total revenue - Total expenses

Net income might be a valid goal for stable businesses that must deliver consistent profit for shareholders. Another type is businesses with significant cash flow needs.

Return on investment (ROI) = Net income / Total expenses x 100

ROI is particularly important during significant growth phases. Another use case is companies with many products that want to allocate their resources better.

2.2 Penetrate the market

Another possible goal is to maximize the market share to:

Penetrate a new market as fast as possible before your competitors do it.

Acquire customers from your competitors.

An example might be free access to ChatGTP 4 only for customers using Microsoft Bing and Microsoft Edge.

2.3. Improve your cashflow

You might want to set a low price, sometimes even lower than your costs, to improve your cash flow.

If your payments to partners and suppliers can be delayed, you can reinvest that money. This might be cheaper than taking credit, especially if you are a startup and your options are limited.

Another way to improve your cash flow is to charge customers in advance, for example, by promoting annual subscriptions.

2.4 Get a stable revenue

Stable revenue allows companies to predict their future condition with greater accuracy and, ultimately, make better decisions. It also helps the company meet its ongoing financial obligations, such as payroll or loans and makes it more resilient to economic crises.

For 5 years, I’ve been running a tech startup without an external investor. Fluctuations -0.1x or +10x of revenue from month to month were extremely difficult to handle, also emotionally. After a while, we transitioned to subscription-based pricing for all our products.

That stabilized the situation.

2.5 Build trust and establish relationships

Many companies offer a cheaper or even a free product to build trust and establish relationships with the customer. In the future, they can offer upgrades or additional products that customers are more likely to consider.

A good example is the special 100% discount codes on product courses I get from Pendo for our community.

It’s safe to assume Pendo must pay for every certificate their partner, Credly, issues.

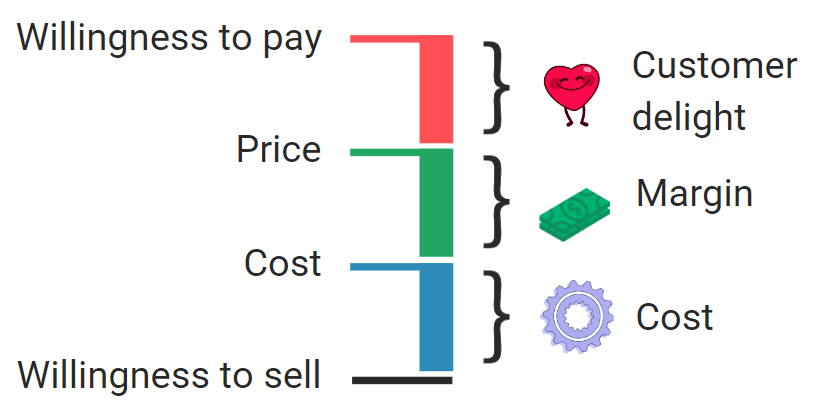

3. The Value Stick

The Value Stick is a conceptual tool used to illustrate how value is created and divided among different stakeholders in a transaction:

The goal for businesses is to adjust the elements of the value stick to maximize their portion of the value (profit) while maintaining or increasing customer satisfaction and retention.

The key terms:

Willingness to pay: This is the maximum amount customers are willing to pay for a product or service. It represents the perceived value of the product to the customer.

Price: Positioned between the willingness to pay and the cost of production, the price is what the firm actually charges for its product or service. It's a crucial lever for the firm, directly affecting profitability and customer satisfaction.

Cost: This represents the firm's cost of production, including all expenses necessary to produce and deliver the product to the market.

Willingness to Sell: While not always explicitly illustrated in the Value Stick model, this concept is crucial for understanding the supply side of the equation. It's the lowest price at which suppliers are willing to provide the raw materials or services necessary to produce the final product.

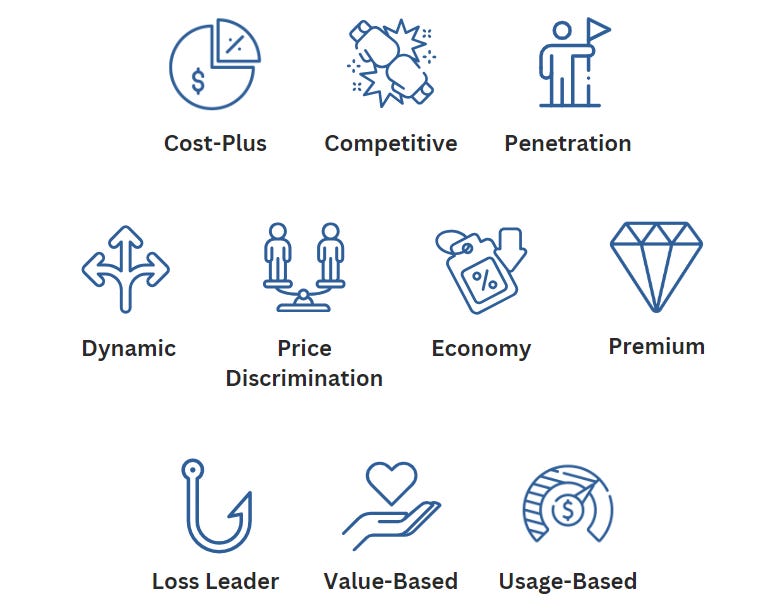

4. 10 product pricing strategies every PM should know

Here are the most important product pricing strategies you should know as a product manager.

Note that some of them can be combined:

Before we dive in, it’s important to remember that for digital products, costs tend to grow slower than revenue due to low marginal costs.

It’s virtually free to copy a digital product. They are also easier to scale, distribute, and maintain.

4.1 Cost-Plus Pricing

This is a method of setting prices where the selling price is determined by adding a specific amount or percentage to your total cost.

This strategy is commonly used in physical products with tangible costs, retail, and manufacturing industries.

Many consulting companies like McKinsey, Delloite, and Accenture use the same approach charging their customers based on the hourly rates of their consultants (aka “time & material”).

The low marginal cost of digital products makes cost-plus pricing less relevant.

4.2 Competitive Pricing

It’s a strategy considering what competitors charge for similar products.

For digital products, given their lower marginal cost, there might be more flexibility to adjust prices based on competition.

At the same time, competing with price in a digital space is often a terrible idea. It ultimately causes all the competitors to operate on extremely low margins, which is often referred to as the “red ocean.”

A better approach is competing to be unique, for example, by solving specific customers’ problems way better than anyone else, providing superior user experience, or ensuring frictionless onboarding.

4.3 Penetration Pricing

Penetration pricing is a strategy businesses use to attract customers when they enter a market with a new product.

The company initially sets a low price to attract customers away from competitors and to gain market share quickly.

Once the product is established in the market and customer loyalty is built, the price typically gradually increases.

Good examples are:

Netflix: When Netflix initially launched its streaming service, it offered a low price to attract new subscribers. Once they had established a substantial user base, they gradually increased their prices.

Uber: When Uber first entered various markets worldwide, it offered significant discounts to attract users away from competitors like taxi corporations. Over time, the promotional offers were reduced.

4.4 Dynamic Pricing

Also known as surge pricing or demand pricing, it’s a strategy where businesses set flexible prices for products or services based on current market demands.

It’s commonly used, for example, in the travel, entertainment, and conferencing industries due to the limited “inventory” that companies want to sell at the highest possible price.

Most people experience it when booking flights or hotels. For example, Booking.com and American Airlines.

Digital products typically don’t have similar constraints, so the Dynamic Pricing strategy is less relevant.

4.5 Price Discrimination

This involves charging customers different prices for the same product or service, often based on the maximum they're willing to pay. One of the Price Discrimination types is Location-Based Pricing.

A good example is Justin Welsh's location-based discounts for his Content Operating System:

If you are curious, Justin used ParityDeals. Interestingly, the solution can’t be tricked by popular VPNs (I tested it with AtlasVPN; I’m not an affiliate).

4.6 Economy Pricing

Economy pricing involves setting a low price for products with minimal marketing or promotional expenses to keep the price as low as possible. This strategy often targets a large market segment that is very price sensitive.

Examples:

Walmart: Known for its "Everyday Low Prices" mantra, uses this strategy to attract a wide customer base. They do it through efficient supply chain management and economies of scale.

IKEA: They achieve this through efficient production and logistics, flat packing of products, and customer self-service.

Southwest Airlines: It has effectively used an economy pricing strategy to become one of the most successful low-cost carriers in the world. They use a single aircraft type (Boeing 737). They don't offer assigned seating, free meals, or first-class cabins. Southwest Airlines focus on efficient operations and sell most tickets directly from its website to avoid travel agents’ commissions.

Economy Pricing might not the best strategy for digital products, as it’s easier to achieve product differentiation.

4.7 Premium Pricing

This is the opposite of Economy Pricing. It's used when a company deliberately sets the price of its product higher than the competition to cultivate a perception of superior quality.

Luxury brands like Apple, Rolex, and Gucci often use this approach.

While premium pricing can improve profitability, it must be justified by delivering exceptional value, quality, customer service, and brand prestige.

3.8 Loss Leader Strategy

This strategy involves selling a product at a price that is not profitable, but it can help attract new customers or sell additional products and services.

Examples:

Amazon: It has been known to sell Kindle devices at a loss, with the expectation that it will make up for the loss through digital sales (like eBooks, movies, and music) and prime memberships.

Gillette: They sell razors at a low price but set high prices for replacement blades, which customers must repeatedly purchase to continue using the razor.

4.9 Value-Based Pricing

Value-Based Pricing is a strategy where prices are based on the perceived value of a product.

It has several advantages:

Focuses on Customer Value: Value-Based Pricing is all about charging what customers are willing to pay. It shifts the focus from the cost of production or market to the actual benefits your product provides.

Maximizes Profitability: In this model, companies can capture a larger portion of the value they create. This can lead to higher profitability, especially for software products where the marginal cost (cost of producing an additional unit) is virtually zero.

Flexibility: Value-Based Pricing allows for a lot of flexibility. Prices can be set differently for different market segments based on the value they perceive. A good example is Microsofts’ offering for educational institutions.

Customer-Centricity: Value-Based Pricing requires a deep understanding of the customer, their needs, and how they perceive value. This encourages companies to be customer-centric, which leads to better products, better customer experience, and higher intrinsic motivation of your employees.

Examples:

Apple: It combines Premium Pricing and Value-Based Pricing. Apple has successfully created a strong brand and a perceived value around the quality, design, and user experience of its products.

Tesla: Tesla's electric vehicles are priced based on their perceived value. Customers who buy a Tesla are not just buying a vehicle; they're buying a high-end, environmentally friendly lifestyle and a future vision. There are some nuances, as the brand is perceived as premium and, at the same time, uses Penetration Pricing to expand the EV market and make electric vehicles more affordable.

Diamonds: Value in the diamond industry rests almost exclusively on perceived value and scarcity. Diamonds have value primarily because we believe they have value.

Implementing Value-Based Pricing requires in-depth market research to understand how customers perceive value. You also need to develop a specific strategy to capture it.

That's why Value-Based Pricing is often seen as the "holy grail" – highly desirable but challenging to achieve.

4.10 Usage-Based Pricing

A SaaS pricing model in which customers are charged based on what they use.

Good examples are:

Amazon AWS

Microsoft Azure

Zapier

Usage-based pricing:

Allows greater flexibility, as customers pay based on their needs

Shortens the purchasing cycle as it’s easy to start

Improves customer satisfaction and retention.

5. Pricing strategy in the context of product strategy

Keep reading with a 7-day free trial

Subscribe to The Product Compass to keep reading this post and get 7 days of free access to the full post archives.