Hey, Paweł here. Welcome to the free archived edition of The Product Compass.

If you are new here, here you can find the best issues I have published so far: https://www.productcompass.pm/archive?sort=top

Premium subscribers can also attend a Continuous Product Discovery Masterclass video course and get certified for free.

How to Achieve Product-Market Fit? Part I: Market and Value Proposition

In Today’s issue:

The key reason most new products fail

Step 1: How to come up with a good initial idea?

Step 2: How to analyze the market and the industry?

🔒 Step 3: How to analyze customers’ needs and segment the market?

🔒 Step 4: How to define value proposition?

Next week (Part II: Product and Business Model):

Step 5: How to define a product idea?

Step 6: How to validate a product idea?

Step 7: How to achieve product-market fit?

Practical insights and tips.

The key reason most new products fail

Working on a new product might be a rollercoaster ride.

The reality is that in the long term, 90% of startups fail.

Many who don’t fail immediately struggle to survive. Founders often work overtime and earn less than they could receive on the open market.

And less than 1% of startups become unicorns.

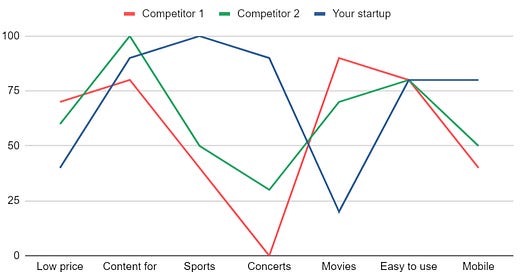

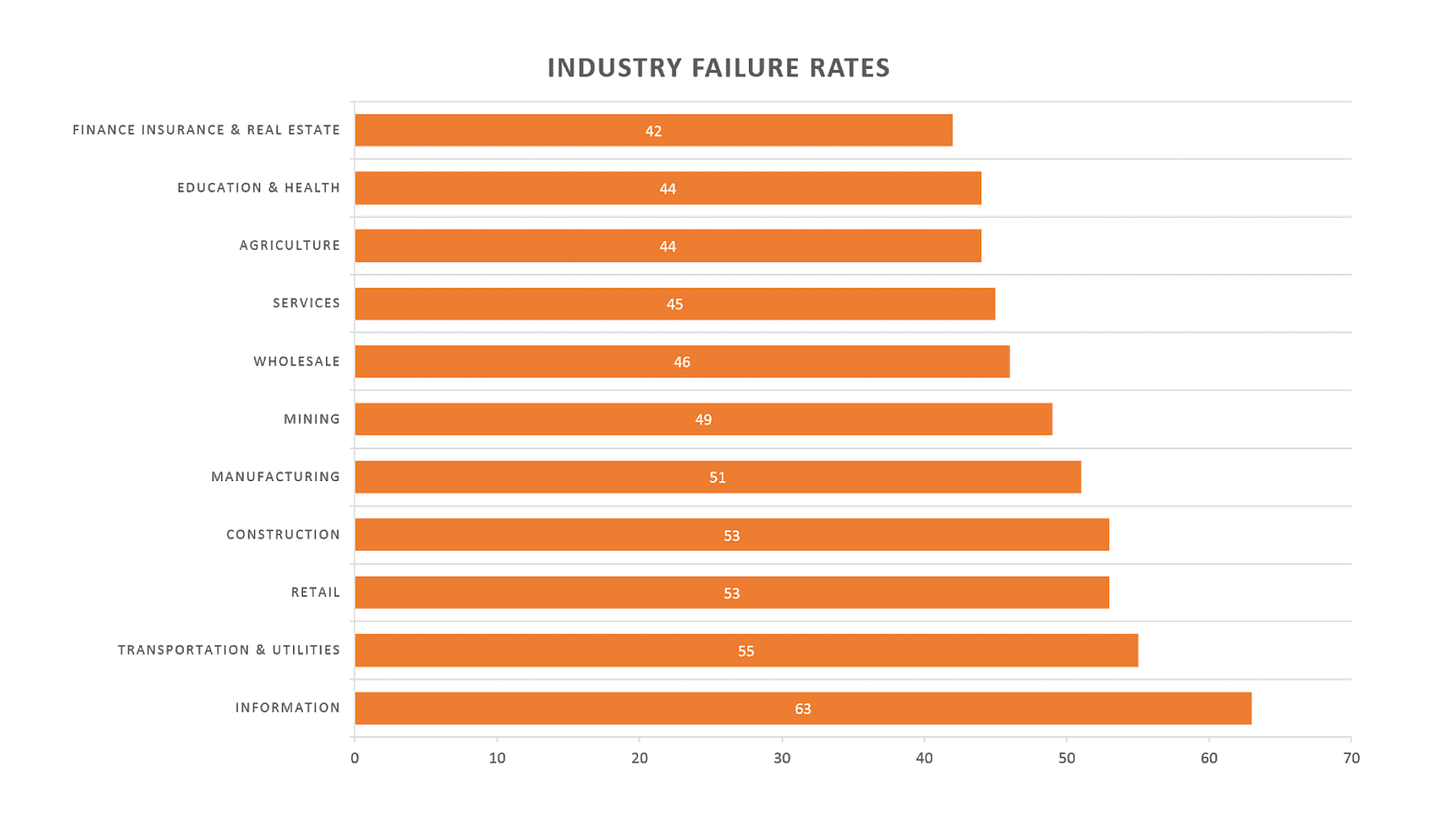

Interestingly, business failure rates are consistent across most industries, with “Information” being the riskiest. Industry failure rates after 4 years:

As Alberto Savoia explains in The Right It, you should assume failure is the most likely outcome:

“Most new products will fail in the market, even if competently executed.” - The Law of Market Failure, Alberto Savoia, The Right It

The Law of Market Failure remains valid whether you are a new business or a successful, existing company. Below, you can find:

100+ failed products in Google Cemetery (e.g., Google Play Music, Google+)

50+ failed products in Amazon Cemetery (e.g., Fire Phone, Amazon Auction)

The number one reason for those failures?

Building something nobody needs. Which reflects a lack of product-market fit.

In this issue, I’ll focus on achieving product-market fit, which can be defined as:

“(…) your product meets real customer needs and does so in a way that is better than the alternatives” - Dan Olsen, The Lean Product Playbook

Note: My experience with startups and new products.

For 5 years, I ran a tech startup in Poland, where I was the head of Product, Sales, and Marketing. We never received venture capital funding and started the company with just $10K in capital.

We made many mistakes, but building a product that lacked the product-market fit wasn’t one of them. We iterated like crazy with different product ideas and prototypes and signed the first contracts, often collecting initial payments, before investing in our products.

The company specialized in ready-to-use electronic document workflows and plug-and-play corporate intranet. Our customers included the largest banks, financial institutions, energy companies, and airlines from Poland, as well as international companies like OTIS (elevators), Pratt & Whitney (Airbus A310 engines), and GKN (FTSE 100).

I sold my shares and left the company in 2019.

Step 1: How to come up with a good initial idea?

If you are used to Continuous Product Discovery, you might assume you should start by interviewing people to figure out who your customers are and what their underserved needs are.

But that’s not the best approach.

I agree with Jared Friedman from Y Combinator. In most cases, new ideas appear naturally when you see people having a specific problem or, even better, when you experience a specific problem yourself.

However, if you need a structured approach to idea generation, here are seven strategies you can use immediately (starting at 21:26):

What will help you the most in the initial phase is asking yourself those two questions:

Is this a burning, painful problem for the users? Merely creating some value is not enough. Too many products compete for our attention. Can you create exceptional, irresistible value? In particular, is this a technology searching for the problem (e.g., another AI tool) or a real customer need?

Is this the right problem for your team? Does your team have the skills and experience to tackle this problem effectively? Not every good idea is the right idea for your team. This is often referred to as founder-market fit.

Step 2: How to analyze the market and the industry?

Customer interviews might be more time-consuming, so before you dive into them, there are 4 questions related to the market and industry I recommend you answer:

Step 2.1: What business are you in?

There is a common misconception about what constitutes a market.

Markets are defined by people's problems, not technologies or types of solutions. For example, commercial airlines are in the transportation business.

For more information about markets and marketing, you can read Product Management vs. Product Marketing vs. Product Growth 101.

Step 2.2: Is this the right industry to be in?

Every industry, which Y Combinator often refers to as an “idea space' (a class of similar ideas solving similar problems), has distinct metrics, such as average ROI, monthly churn, conversion rate, etc. These metrics tend to remain relatively stable over time.

For example, it’s common knowledge that for decades, commercial airlines have been one of the worst industries to be in.

You can analyze your industry with the help of Porter's Five Forces model, which considers five structural forces:

Rivalry among existing competitors - the lower, the better

Threat of new entrants - the lower, the better

Threat of substitutes - the lower, the better

Power of buyers - the lower, the better

Power of suppliers - the lower, the better

A video explanation:

Free template (Miro): https://miro.com/templates/porters-five-forces/

It’s worth noting that Porter's Five Forces model doesn’t include temporary factors and the local business environment in which your company operates. To account for those factors, you can perform a PESTEL Analysis.

The acronym stands for Political, Economic, Social, Technological, Environmental, and Legal factors.

Video explanation:

Free template (Miro): https://miro.com/templates/pestle-analysis/

Step 2.3: Is there any competition?

While Porter's Five Forces model suggests low competition is a good thing, there is an exception: no competition at all.

There are a few possible explanations:

Perhaps what you are attempting has only recently become possible.

Maybe it’s a boring industry, like accounting, where ideas may remain unexplored for longer.

On the surface, the problem seems easy to solve, but in practice, solving it is extremely hard or impossible. This is what Y Combinator refers to as “tarpit ideas.” Try to find and talk to those who have worked on it before. Why did they fail? What makes you think you won’t?

Highly unlikely: no one has thought of this idea before.

Step 2.4: How big is the market?

Let’s assume you are in an activity booking software business and you specialize primarily in escape rooms. Your software is available only in English.

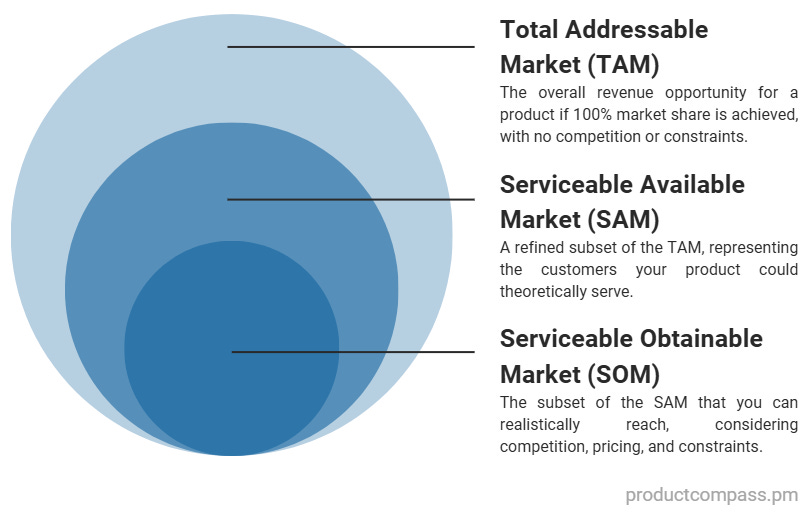

You typically want to size your market using the following metrics:

Many companies would do it like this:

Total Addressable Market (TAM) - the total revenue of all activity booking solutions worldwide. For example, $3 billion / year.

Serviceable Available Market (SAM) - the total revenue of all activity booking solutions in countries like the US, Great Britain, and Australia. For example, $1 billion / year.

Serviceable Obtainable Market (TOM) - for example, $100 million / year, considering we specialize in escape rooms.

In Debunking 17 Common Misconceptions in Product Management, I quoted Roger Martin to argue that it's essential to focus on a smaller market. As Roger Martin explains:

“Never define yourself as a small player in a big TAM and don’t spend your time chasing big TAMs. They are a trap. Playing to play in a giant existing TAM — like ‘services,’ ‘US healthcare,’ or ‘China’ — is a trap.” - Roger Martin, Medium

For example, it’s better to aim to become the #1 booking solution for escape rooms than the #20 booking solution for any activity provider you can imagine.

So, in the activity booking software example, a better TAM might be the total revenue from all activity booking solutions for escape rooms worldwide ($/year). Similarly, you can constrain the SAM.

While the TOM is likely the same, changing the perspective to a smaller TAM will better guide and inform your future decisions.

“Instead, focus first on winning in a smaller TAM and once you are a winner there, then broaden from a position of strength, not of weakness” - Roger Martin, Medium

Step 3: How to analyze customers’ needs and segment the market?

Keep reading with a 7-day free trial

Subscribe to The Product Compass to keep reading this post and get 7 days of free access to the full post archives.