Three Proven Strategies to Monetize AI Features in SaaS (Q4 2024)

How to Monetize AI: The State of AI Monetization Across the 500 Top Players in SaaS

Hey, Paweł here. Welcome to the archived edition of The Product Compass!

Every week, I share actionable insights and resources for PMs.

Consider subscribing and upgrading your account for the full experience:

Today, our guests are co-founders of PricingSaaS: John Kotowski and Rob Litterst, who help SaaS GTM teams get better at monetization.

This post was not sponsored. I hope you enjoy this deep AI monetization research as much as I did.

AI as the Hottest Topic in SaaS

Unless you’ve been living under a rock, you know generative AI has been the hottest topic in SaaS this year. Companies are launching products rapidly, experimenting with new AI pricing models, and expanding AI-powered capabilities.

At PricingSaaS, we’ve been watching closely.

PricingSaaS tracks trends across the 500 top players in SaaS.

Today, we want to share what we’ve found. Specifically, we’ll cover:

The Pace of AI Monetization,

Three Proven Strategies to Monetize AI Features in SaaS,

Top Five Capabilities Powered by AI.

This post is jam-packed with data and examples, and you should come out of it with a clear picture of how AI has evolved in 2024 and where it’s going next.

Let’s get to it.

The Pace of AI Monetization

This year, we’ve seen an explosion of AI features and functionality across all types of SaaS products.

Unfortunately, we’re seeing a recurring theme: product teams are shipping first and monetizing later.

This has often been the case historically and is the basis for books like Monetizing Innovation, which highlights how aligning pricing and product pre-launch can have a massive impact on product adoption and revenue growth.

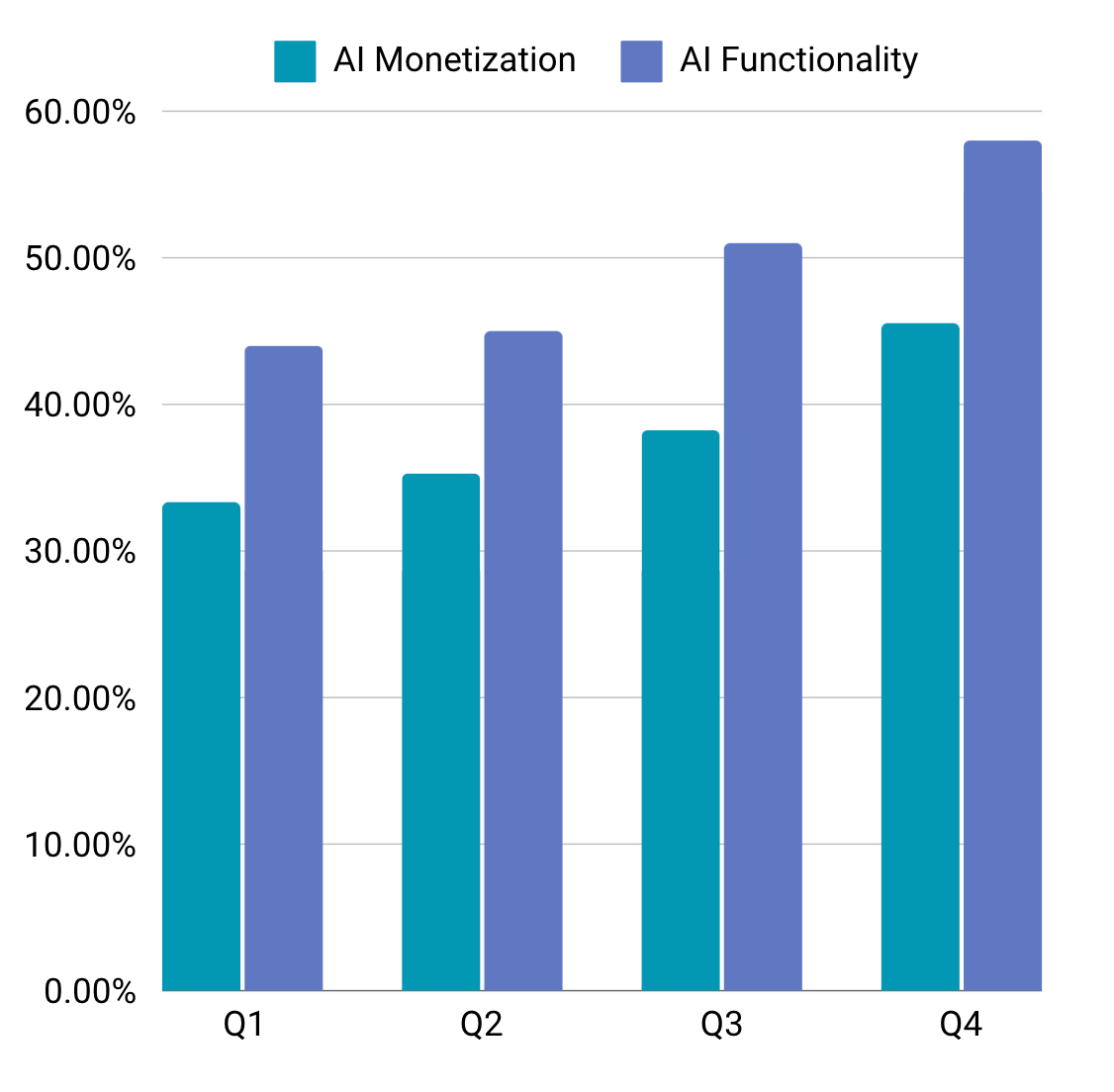

At PricingSaaS, we’ve been broadly tracking pricing trends across the top 500 players in SaaS and have been watching AI pricing strategies unfold over the past year. The gap between AI functionality and AI monetization has been persistent:

How to monetize AI?

The good news is that both numbers are on the rise. As a result, we’re seeing various AI monetization strategies come to market. Year to date, we’ve seen three core strategies emerge:

Strategy 1: Integrate AI Into Existing Tiers,

Strategy 2: Usage-Based Model,

Strategy 3: Add-On Model.

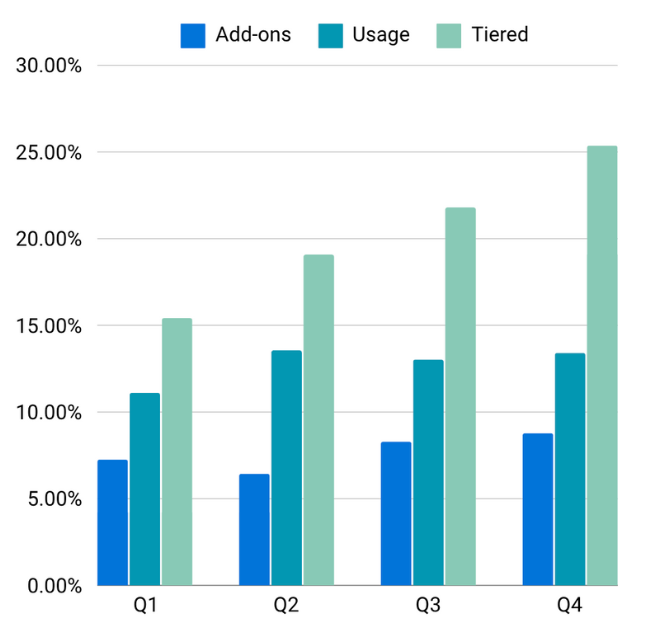

Tiers are leading the way. We believe this is a combination of legacy billing systems inhibiting more creative pricing models and uncertainty around customer willingness to pay:

Importantly, these models are not mutually exclusive, and we’ve seen a number of hybrid approaches as well.

Next, we’ll dig into each strategy, highlighting the benefits and drawbacks and showcasing examples from leading SaaS companies.

Three Proven Strategies to Monetize AI Features in SaaS

As mentioned, we observed three AI monetization strategies across the top 500 SaaS players. Each high-level strategy has multiple approaches to go to market.

Below, we’ll cover the patterns we’re seeing and share examples of companies actively using these strategies.

Strategy 1: Integrate AI Features Into Existing Tiers

Integrating AI features into existing tiers is the most popular approach. Top 500 SaaS Companies:

There are three main ways SaaS companies integrate AI features into existing tiers:

AI across all tiers as a core feature,

A differentiator,

A premium feature.

Let’s dive into the details.

Approach A: AI as a Core Feature

Offering AI as a core feature entails adding AI functionality to all plans. While it meaningfully reduces your ability to monetize AI directly, there are benefits to this play, including:

Faster product adoption across your customer base,

Stronger competitive positioning,

Stickier product,

Can amplify usage of other features.

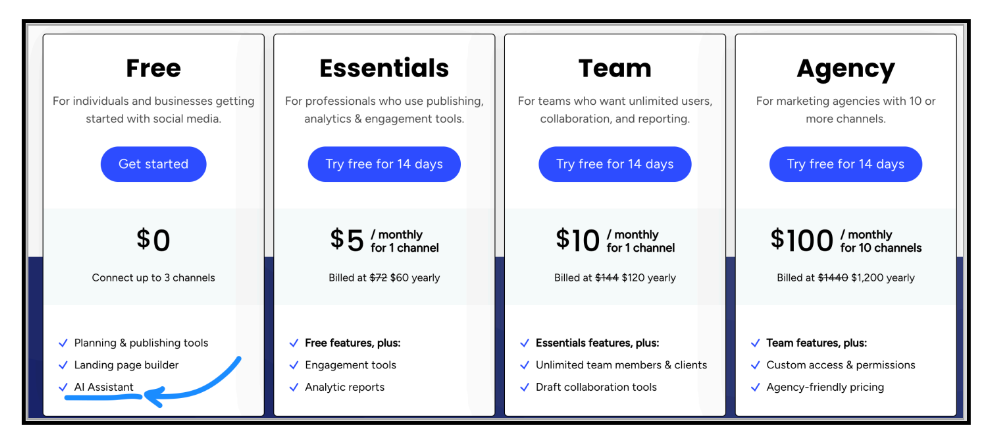

Example: Buffer includes AI features across all tiers, potentially reducing monthly churn from 300 to 255 customers (15% improvement):

Approach B: AI as a Differentiator

Next, we’re seeing companies utilize AI to drive upgrades from free to paid plans. This is a conventional way to monetize AI, especially if the capability you’re monetizing garners willingness to pay.

Some of the benefits of this play include:

Direct contribution to AI monetization,

Offers a controlled rollout of AI capabilities,

Positions AI capabilities as valuable features.

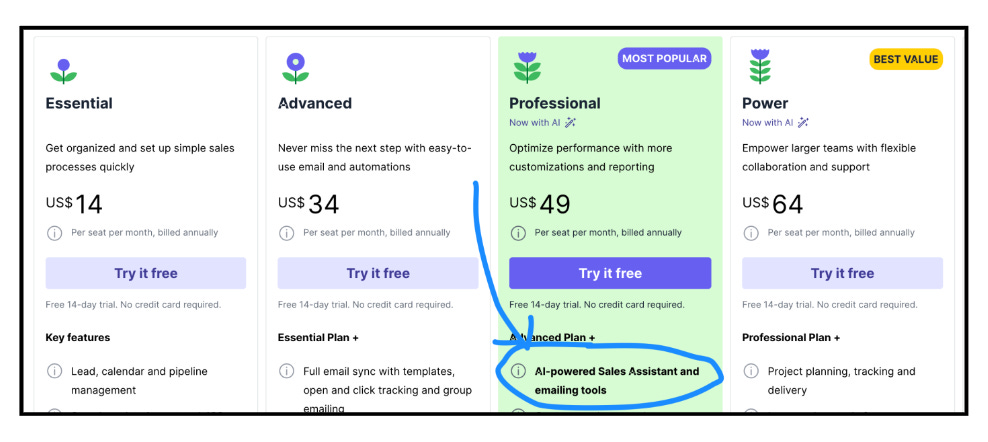

Example: Pipedrive's AI-powered Sales Assistant drives 44% expansion revenue through upgrades from $34 to $49 per user:

Approach C: AI as a Premium Feature

Lastly, companies reserve AI features for Enterprise customers, giving AI capabilities a premium value perception.

Benefits of this play include:

Strengthens enterprise value proposition,

Creates a powerful negotiation lever,

Offsets higher support costs.

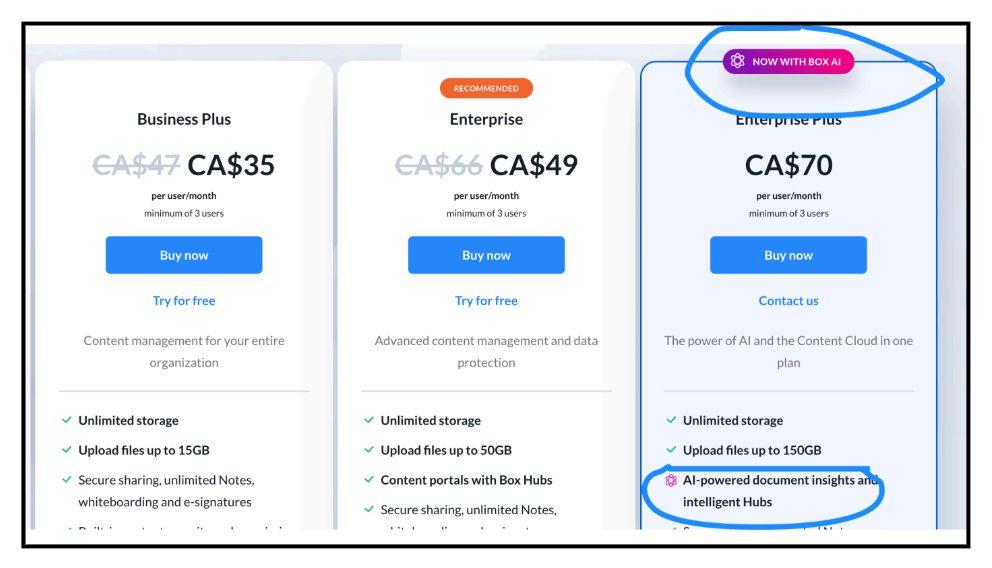

Example: Box's Enterprise Plus tier commands a 43% premium over standard Enterprise through AI-powered features:

Strategy Summary

Regardless of the approach, integrating AI into existing tiers offers several strategic advantages compared to other models, including:

Faster feature adoption within targeted tiers.

Lower operational complexity than add-on models.

Stronger tier differentiation.

In other words, if you’re looking for a low-lift way to strengthen your existing plans and drive immediate adoption of AI capabilities, tiers are the way to go.

But there are a few downsides. Tiered AI pricing models:

Make it harder to measure direct ROI from AI features.

Limit the ability to capture value from power users.

Offer less control over margins than Add-Ons or Usage-based models.

Speaking of which, the adoption of Usage Based models, while still well behind Tiers, has risen quickly this year.

Keep reading with a 7-day free trial

Subscribe to The Product Compass to keep reading this post and get 7 days of free access to the full post archives.